Land Acquisition Guide

Last Updated March 10, 2024

See Our List of Metro Home Pages and Select/View Yours

Land Acquisition Guide

From Offer to Contract

Locating and acquiring the perfect tract of land to develop can be quite challenging. An experienced developer and its real estate broker can conduct initi ue diligence to help avoid costly issues. However, more in-depth inspections and research are necessary before finalizing a purchase. Whether a buyer is planning on developing the site or holding for investment purposes for future resale, the required due diligence remains the same. Bottom line, you need to determine if you can do what you want to do with the property, what that process is likely to cost and how long is the process likely to take?

Offer

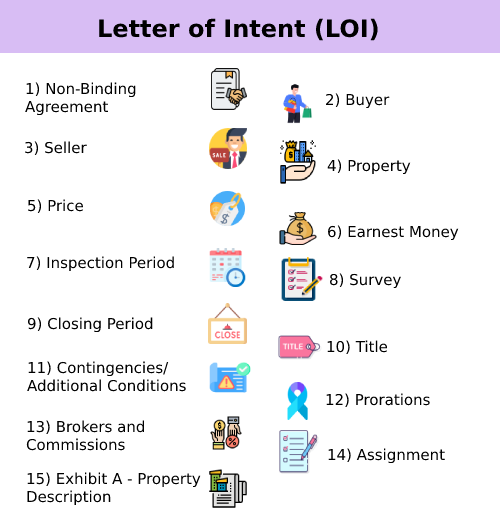

Before you can get the process moving, as a buyer, you must decide what price you are going to offer for the property. By communicating with your broker, you can determine market values for comparable property, motivation of the seller, and the buyer’s ability to fund. Some initial due diligence on potential development and operation costs can also help you make a more informed decision on what the property is worth. This research can help you avoid having to renegotiate the price during the Contract. Once you are comfortable with the pricing and have all of your other required contract criteria defined, you can prepare a Letter of Intent to purchase. The basic outline of an LOI consists of the following:

Contract

So you now have an agreed-upon LOI between the Buyer and Seller. Now you need to prepare a mutually agreeable contract. There are many forms of earnest money contracts and purchase money contracts. In Texas, if you are a member of the Texas Association of Realtors, you are authorized to use their forms. We like to use the Texas Association of Realtors (TAR) Commercial Improved and Unimproved earnest money contracts. They are simple, seem balanced in protections, and have every imaginable addendum needed to cover a deal. Some attorneys will want addendums - especially “As-Is where Is” type addendums. However, the buyer should consider the ability to close within a given time frame and allow for adequate time in case of delays by the lender, title company, or with inspections. If a buyer is using outside financing, we prefer to see at least 60 days of inspection period to allow time for the lender to:

- formally underwrite and approve the borrower;

- conduct its review of the title commitment;

- Prepare, review and approve a property boundary survey, if needed;

- Conduct the appraisal and;

- Prepare a phase one environmental study.

DUE DILIGENCE

So now you have successfully negotiated the Contract, all parties have executed the document, the title company has received a copy and sent out the receipted contracts. The date the title company sends out the receipted Contract to all parties will generally establish the Effective Date of the Contract, which is crucial in determining the critical dates tied to the Contract. Now the real work - in the form of Due Diligence - begins. Some of this work may have started in the preliminary review of the site. Due diligence is broken down into six sections:

Physical

Physical This includes Site inspections, Drainage and Detention, Utilities, and Planning.

Site Inspections This seems self-explanatory. Walk the site, review aerial photographs, view floodplain maps, adjacent property uses, and physical characteristics. We also encourage our clients to talk to neighboring owners, if possible, to see if any unknown concerns might affect the property.

Drainage and Detention Enlist a qualified civil engineer to examine the site drainage patterns along with available city/county drainage. This examination will enable the engineer to provide preliminary calculations for detention on the site given a particular use along with estimates for required storm drainage within the parcel.

Utilities - (Water, Sewer, Natural Gas, and Electricity) - Your civil engineer can assist in determining available services for the site. Such research is covered in more detail in the “Utilities” section later in this article. However, initially, your civil engineer will access GIS maps to locate the nearest water, sewer, and storm drain lines and access the size of each. Discussions with the water and sewer provider must include its ability to provide the property necessary water and sewer capacity and what expenses may be associated with making those connections.

Planning While partially covered in the Zoning review under “Title,” a thorough examination of the applicable Codes and Ordinances affecting a property are crucial. A “Pre-Development Meeting” with the local municipality is needed. The Zoning ordinances will tell you if you are allowed to conduct a particular use the target area. However, you need to understand the city’s requirements for developing the site. These can include traffic safety improvements (dedicated turn lanes, traffic lights, etc.), all of which can be incredibly expensive. There will likely be additional requirements for types of construction, access, parking, setbacks, landscaping, fencing, fire safety access lanes, fire sprinklers, drainage/detention, and much more. These, too, can add significantly to the overall cost of your development. The city or county may require that the property be re-platted to obtain a permit for any construction.

If one could count on people to “play nice” with each other, you might have more options. There are certain things - probably more than we’d like to admit - that simply must be subdivided into completely separate and isolated areas, for interpersonal, legal, business, or other practical reasons.

CLOSING

Assuming all has gone well with the due diligence and the buyer is ready to close, the title company, attorneys, lender and buyer/seller begin gathering the documents required for closing.

- Deed The Deed is the document which officially transfers title from the seller to the buyer. The Contract will specify whether the Deed is to be a Special Warranty (also called a Limited Warranty Deed) or General Warranty Deed. The former only warrants the title from the date the seller gained ownership, and the latter ensures clear title from the time of land conveyance to the new owner. This article does not thoroughly go into the types of deeds and every nuance contained within. However, the main elements of a Deed are:

- Buyer and seller clearly defined

- Consideration was present and defined

- Description of the land to be conveyed - preferably a proper legal description with referenced Exhibit

- Signature of Buyer and Seller

- Actual delivery of the Deed and Acceptance of the Deed

- Note: A qualified attorney is required to prepare the Deed. The buyer’s attorney - if not the preparing attorney - needs to review the document as well.

- Final revised Title Commitment - The title commitment is one of the first documents delivered during the contract period. The earnest money contract defines Delivery time expectations. Revisions can occur numerous times over the contract period. The Contract also establishes the period within which the buyer may object to exceptions contained within the title commitment. Each time the TC exceptions are removed or modified, the title commitment is revised by the title company and distributed to the parties of the Contract until the TC becomes as “clean” as possible, given the various recordings affecting the property.

- Loan Documents - Lender documents tend to be one of the items to hold up or extend closings more often than any other requirement. Lenders generally take every minute all scheduled to prepare the necessary documents for closing. This more extended period extends the period a Buyer usually requires at least 45 days of inspection time if they are pursuing a bank loan to allow the lender time to complete all of their required tasks.

- Release of liens -Arrange for any liens on the property to be released before closing. These can include mortgage liens, contractor liens, IRS tax liens, etc.

- Replat -If a party requires a Replat before closing, evidence of this requirement must be provided to the buyer’s lender at, or prior too, closing.

As you can tell, purchasing property can be a complex process that shouldn’t be undertaken lightly, nor without the support of experienced professionals.

Are you looking for Warehouse, Office or other space in Houston or elsewhere? Do you need to renew your lease? Contact Warehouse Finder using our Get Started link above, call us at the phone number on this page in the upper right, or chat with us using our chat widget on the page in the lower right.