If you own a business - even if you don’t own the building - you may want to consider commercial solar for your business. The return on your investment is highly favorable and there are huge tax benefits and an array of other government programs…

(* Disclaimer: Okay, okay - Real Estate does tend to throw a few knucklers, but we'll get you through them.)

This page shows you all of the Articles and Links you requested. Assuming you have an account and are signed in, you will see a link to save the Article or Link to "Saved A&L" for later review. Once you do either, the Article or Link will be moved. You will need an account to use these features, and you must be signed in as well.

If you own a business - even if you don’t own the building - you may want to consider commercial solar for your business. The return on your investment is highly favorable and there are huge tax benefits and an array of other government programs…

Having just completed a six month search for “warehouse for sale” property for a client to purchase, I can tell you definitively that the far West Katy and Brookshire industrial market is significantly under served. We finally settled on a 17,000 SF warehouse building with 2,000 SF of office finish and sitting on 5 acres of land. Pricing is in the $1,300,000 range.

With approximately ten warehouses available to purchase in this growing market West of Houston, the task of locating an industrial building which fits a buyers needs can be quite challenging. Freestanding options to buy are typically have grade level foundations and may be metal or tilt-wall in construction. For owners needing dock high loading, dock wells can be installed to accommodate container loading and unloading.

With approximately ten warehouses available to purchase in this growing market West of Houston, the task of locating an industrial building which fits a buyers needs can be quite challenging. Freestanding options to buy are typically have grade level foundations and may be metal or tilt-wall in construction. For owners needing dock high loading, dock wells can be installed to accommodate container loading and unloading.

The few “new” warehouse for sale options are priced in the $90 to $110 PSF range and generally have minimal outside storage. Several options though are located on five to 10 acres of land and a bit further North and West of Katy. Those options have improvements of older construction and typically metal buildings.

Some of the options only lasted a few days or weeks before being contracted to sell. The exploding residential development with sought after Katy school district and Class retail options have created a huge demand from business owners living West of Houston.

What about the energy bust from a few years ago and the resulting slump in the energy corridor? Although there is still office space oversupply in that far west market, the industrial warehouse market has continued mostly unaffected for the past five or six years. Also, the oil and gas market is strong as of today. And while the industry is more cautious with spending, small operations still need a facility to service the big companies.

So build it…right? Not so fast. Building a facility, even one smaller in footprint, takes time. An owner generally needs 12 months to get a new building up and ready to occupy. Additionally, land prices have gone through the roof with new homes, retail, apartments and medical development. The result is that a new 20,000 SF warehouse with about 20% office finish on approximately 2-3 acres will cost around $90 - $100 PSF to build.

Regardless of your industrial needs, if you are looking for a new space or want to sell or lease an existing location, give us a call. We have been in the Houston Industrial brokerage business for more than 26 years.

Looking for Warehouse or Office space in Houston?

Centermark Commercial Real Estate specializes in Industrial and Office in the Greater Houston area. CCRE is the exclusive affiliate broker for WarehouseFinder.NET in Houston, TX.

Commercial real estate owners, business owners and developers need to pay attention to the projected demographics related to the Hispanic population in Texas. Today at the A&M sponsored TREC MCE course, Steve Murdock of Rice University illustrated the overwhelming trend of Hispanic population growth in Texas. Anglo population is set to decrease. Future developments and planning should plan accordingly.

Looking for Warehouse or Office space in Houston?

Centermark Commercial Real Estate specializes in Industrial and Office in the Greater Houston area. CCRE is the exclusive affiliate broker for WarehouseFinder.NET in Houston, TX.

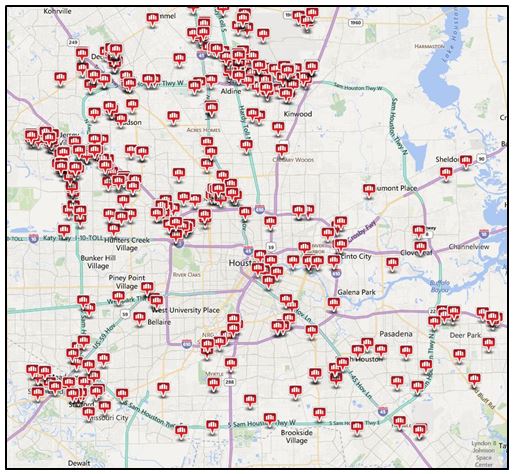

Houston’s shift in industrial warehouse demand from the West side of town to the East market is undeniable. While historically light on fractional vacancy, East Houston and the inner Port of Houston market is now incredibly tight on available a space. Even more concerning, this submarket has an even stronger outlook with increased break-bulk traffic foreseen for the port and continued rise in manufacturing and refining. What is available now? See a map below (from Costar.com) of available space for lease between 10,000 and 50,000 SF . I culled the list a bit of functionally obsolescent buildings. Quality space on the East side = almost Zero.

As a tenant/buyer rep broker, I can tell you first hand that locating viable lease/purchase alternatives for clients, near the Port of Houston, has never been more challenging.

Need Warehouse of Office space?

Centermark Commercial Real Estate specializes in Industrial and Office in the Greater Houston area. CCRE is the exclusive affiliate broker for WarehouseFinder.NET in Houston, TX.

Why is there little to no available manufacturing and/or storage warehousing available for purchase or lease near the Port of Houston? Strong local economy? Maybe. Top Port in the Nation in many stats? Partially. Booming energy sector? Possibly, but fading.

The real reason the industrial lease and sale market is so tight in East Houston near the port of Houston is due to an almost complete lack of development over the past 30 years in the Loop 610 East/Hwy 225/I-10 East/Port of Houston corridor out to Beltway 8. Yes there have been a few distribution projects which were developed on a speculative basis, however those have been full for some time. As for freestanding crane served warehouses from Loop 610 out to Beltway 8…there are less than 4-5 properties available on any given day. Is this a pure shortsightedness of developers? Probably somewhat. However, land is scarce and what is available is overpriced for industrial use. The Panama Canal will be opening soon and with an expected 20% increase in traffic in the short term, where will this business go? Probably to another port with adequate available storage and manufacturing warehousing.

Need Warehouse or Office space?

Centermark Commercial Real Estate specializes in Industrial and Office in the Greater Houston area. CCRE is the exclusive affiliate broker for WarehouseFinder.NET in Houston, TX.

Warehouse brokerage in Houston, Texas…wow, what a year. 2013 may end up being a record year for many Houston commercial brokers, given the tremendous influx of businesses relocating and/or expanding into the area. However, the high demand results in “slim pickings” for business owners looking to acquire a warehouse for lease or sale. With an approximate vacancy rate of around 4.9% in 2013, the industrial real estate sector has little inventory for potential owners and lessees.

Moving into 2014, warehouse lease and purchase prospects will see continued rental and sales price increases on available warehouse space and premium rates and prices for the record number of freestanding warehouses under construction and proposed for the new year. The new construction is also driving up land prices and reducing availability of land parcels which lend themselves to industrial development.

As an Industrial real estate broker with 22 years in the Houston area, I am blessed to be doing business in Houston and really appreciate both the rewards and the challenges this market brings.

Eric Hughes - Industrial Real Estate Broker

Need Warehouse of Office Space?

Centermark Commercial Real Estate specializes in Industrial and Office in the Greater Houston area. CCRE is the exclusive affiliate broker for WarehouseFinder.NET in Houston, TX.

The overall tone in the Houston commercial real estate market is an optimistic one. Experts are speculating a continued turn-around for this year and beyond. One would assume this is good news for Houstonians - not necessarily. It seems property owners are not the only ones paying attention to real estates “sunny forecast.”

In a preemptive attempt to balance the market values with the appropriate taxes, the Appraisal Districts have begun to increase commercial real estate property taxes. According to Harris County Chief Appraiser, Jim Robinson, “the values of commercial and industrial real properties and apartment properties are all beginning to show strong signs of economic recovery. These three categories of property are expected to increase between 6-11%.”

Out of 600 commercial real estate properties included in a recent study, it was found there are significant appraisal value increase, across the board:

In every realm, decision making without a thorough understanding of all factors is never a good thing. Unfortunately for Houston property owners, that seems to be precisely what the Harris County Appraisal District is doing.

So what can you do? Fight your taxes! A professional tax consultant can help you help the Appraisal District to see that through their efforts to “balance” the market, they are actually tipping the tax scale.

Construction of commercial buildings has decreased approximately 28% across the board for industrial, retail and office properties (as reported by Costar,Inc.). This is especially true for speculative warehouse and office buildings for sale by a developer. For the business owner looking to buy a warehouse building or office for his/her operations, this decrease may drive up pricing on existing buildings and reduce availability. I have clients tell me quite often that in this economy there must be a glut of buildings for sale. While that may be accurate in areas of the country with higher than average unemployment and/or a shrinking population, it is quite the opposite in booming cities like Houston, Austin, Dallas, Atlanta, Provo and Phoenix.

While a shortage of funds from lenders for speculative development is a nationwide issue, availability of buildings for sale fluctuates dramatically from city to city. Lender rules for loan approval do not take into account the feasibility of project based on an individual city’s needs and inventory. A bad economy by default forces a migration of people to other, more prosperous areas of the country looking for jobs. This drives up demand in those areas and changes the commercial real estate picture. Tie this surge in demand to a national policy of restrictive lending and you have a shortage of quality buildings for sale.

So, the volume of buildings for sale becomes a relative term and may not correspond to the nationwide economy, especially in a city like Houston, Texas.

Need More Details?

Want more information about something on this page? Need industrial, office or warehouse space? Use our Free Property Search form to provide your information to let our Broker Affiliate Network know about your needs including help assessing an existing lease. You may also call us at (800) 814 - 4214 to begin the discussion.

Please contact us at our Info Email address or use our Contact Us form if you have questions or concerns.

As Seen On