Here we list a few valuable resources for the Houston Commercial Real Estate Market:

- For over 16 years (since 2008), we've operated a warehouse locator service to find industrial space (warehouse, flex, manufacturing...) for you

- All types of businesses and uses - lease, rent, sale, or purchase

- Let us perform a FREE WAREHOUSE SEARCH for you, too!

- No Gimmicks. No Hassles*. Just Quality Brokerage Services!

(* Disclaimer: Okay, okay - Real Estate does tend to throw a few knucklers, but we'll get you through them.)

All Warehouse Finder library_booksArticles and linkLinks

- Crane Warehouse Space for Rent, Lease, and Sale in the Houston, Texas Area

- Crane Warehouse Space for Rent or Lease Near Dallas, Texas

- Find Cold Storage in Dallas/Fort Worth

- Houston, TX, Cold Storage Warehouse

- Bodegas en Renta

This page shows you all of the Articles and Links you requested. Assuming you have an account and are signed in, you will see a link to save the Article or Link to "Saved A&L" for later review. Once you do either, the Article or Link will be moved. You will need an account to use these features, and you must be signed in as well.

New Feature - Search A&L Words

There are 165 Articles and Links in total on our site right now. This page shows them all (paginated) initially. In the past you could sort them by Tag (and maybe other things) accessed from the main menu. NOW you can also sort by the specific words in which you have an interest. If you see a word that doesn't look quite right (i.e. two words with no space, misspelled, etc.), please report it and we'll do what we can to fix the issue.

One or More Of (click to remove):

Must Include (click to remove):

Exclude (click to remove):

Total Articles and Links - 165, Displaying Maximum 20 Per Page

-

library_books Commercial ResourcesArticle SynopsisInformational Tags for this ArticleLocation Tags for this Article

-

library_books Houston freestanding warehousesArticle Synopsis

Houston freestanding warehouses - Sale prices keep rising despite the tapering oil and gas industry.

Informational Tags for this ArticleLocation Tags for this Article -

library_books Warehouse Space For LeaseArticle Synopsis

By providing basic contact information and space requirements, we will narrow down your search to the right For Lease or For Sale properties. We will personally contact you with you matched property profile.

What You Get

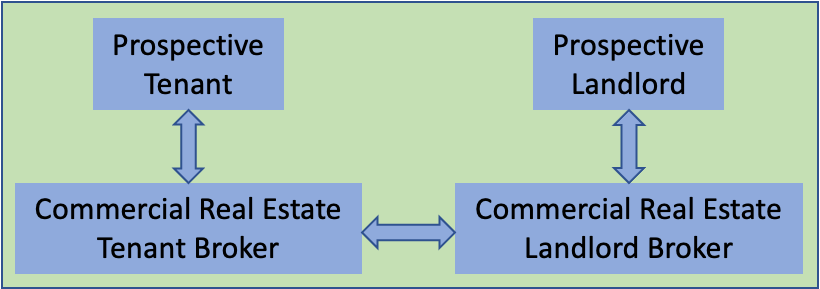

1. Personal Advantages - One on one representation and guidance from a commercial real estate broker

2. Experienced Brokers - 19 years of industrial and office brokerage experience

3. Quick Results - Initial surveys usually provided the same day

4. No endless searches - We are a one stop shop for locating available commercial property, we have premium access to all the major national databases combined with personal knowledge of your market. We are on the streets, familiar with your area.

5. Valuable Guidance - We will treat your sell, purchase or lease as if it is our own business at stake. Our goal is to insure you get the best deal on the property you need.

6. No Obligation - What so ever…

7. Free Assistance -

Our fees are paid by Sellers and Landlords and we represent YOU.

Free Assistance Areas

1. Lease process guidelines - With 1000’s of leases under our belt, we are able to guide you thru all facets of the leasing process, from negotiation to execution.

2. Purchase process guidelines - As with leases, we also have handled 100’s of commercial sales transactions and we can hold our buyer’s hand from price negotiations to closing.

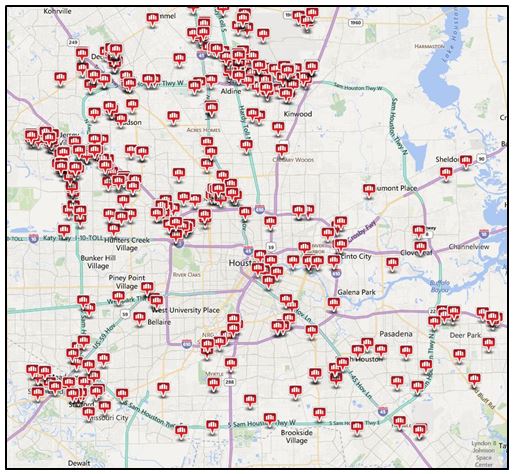

3. Property Summaries - Our available property summaries provide a map of the availabilities along with a description of each property.

4. In Depth Comparisons - We are able to create personal comparisons of the alternatives which allow our clients to make an educated decision.

5. Negotiation - We pride ourselves on our ability to get a deal done and think “outside the box.” This gives us a substantial advantage in negotiating leases and purchase agreements.

6. Inspection - We provide lists of qualified inspectors and personally inspect properties to make recommendations of additional licensed specialists to avoid missing major issues

7. Survey - A category 1-A survey is recommend for our clients and we will work with the Title Company and attorney to review each survey condition

8. Appraisal - With extensive knowledge of our market we work closely with appraisers to ensure the appraisal report is reflective of true market conditions.

Bodegas en Renta

Looking for Warehouse, Office or other space in Houston or elsewhere? Needing to renew your lease?

Contact the WarehouseFinder.NET Broker Affiliate Network below.

Centermark Commercial Real Estate specializes in Industrial and Office in the Greater Houston area. CCRE is the exclusive affiliate broker for WarehouseFinder.NET in Houston, TX.

Informational Tags for this ArticleLocation Tags for this Article -

library_books Texas Hispanic demographics for TexasArticle Synopsis

Commercial real estate owners, business owners and developers need to pay attention to the projected demographics related to the Hispanic population in Texas. Today at the A&M sponsored TREC MCE course, Steve Murdock of Rice University illustrated the overwhelming trend of Hispanic population growth in Texas. Anglo population is set to decrease. Future developments and planning should plan accordingly.

Looking for Warehouse or Office space in Houston?

Centermark Commercial Real Estate specializes in Industrial and Office in the Greater Houston area. CCRE is the exclusive affiliate broker for WarehouseFinder.NET in Houston, TX.

Informational Tags for this ArticleLocation Tags for this Article -

library_books 7,200 SF warehouse on one acre for lease in SE Houston. New Listing!Article Synopsis

Centermark CRE has just listed 8307 Millet Street for Sale or Lease. See flyer link below. The property is grade level with three overhead doors and has plenty of extra yard for building expansion or additional storage. This metal building is fully insulated and has approximately 1,600 SF of office. There is an additional 1,000 SF of covered storage in two, three-sided, buildings.

8307 Millet

Warehouse for Sale or Lease

7,200 SF of 1 Acre

8307 Millet

Warehouse for Sale of Lease

Need Warehouse of Office space in Houston?

Centermark Commercial Real Estate specializes in Industrial and Office in the Greater Houston area. CCRE is the exclusive affiliate broker for WarehouseFinder.NET in Houston, TX.

Informational Tags for this ArticleLocation Tags for this Article -

library_books Mark Lehman joins Centermark Commercial Real Estate!Article Synopsis

Centermark Commercial Real Estate is proud to welcome Mark Lehman to the firm as Partner. Mark has two decades of direct commercial brokerage experience in the greater Houston area. Mark focuses on Land, Industrial and Retail. We are excited to grow the firm and look forward to Mark helping us add long lasting clients and to assist in bringing on quality agents.

Need Warehouse or Office space in Houston?

Centermark Commercial Real Estate specializes in Industrial and Office in the Greater Houston area. CCRE is the exclusive affiliate broker for WarehouseFinder.NET in Houston, TX.

Informational Tags for this ArticleLocation Tags for this Article -

library_books Houston's east side industrial market near 2% vacancyArticle Synopsis

Houston’s shift in industrial warehouse demand from the West side of town to the East market is undeniable. While historically light on fractional vacancy, East Houston and the inner Port of Houston market is now incredibly tight on available a space. Even more concerning, this submarket has an even stronger outlook with increased break-bulk traffic foreseen for the port and continued rise in manufacturing and refining. What is available now? See a map below (from Costar.com) of available space for lease between 10,000 and 50,000 SF . I culled the list a bit of functionally obsolescent buildings. Quality space on the East side = almost Zero.

As a tenant/buyer rep broker, I can tell you first hand that locating viable lease/purchase alternatives for clients, near the Port of Houston, has never been more challenging.

Need Warehouse of Office space?

Centermark Commercial Real Estate specializes in Industrial and Office in the Greater Houston area. CCRE is the exclusive affiliate broker for WarehouseFinder.NET in Houston, TX.

Informational Tags for this ArticleLocation Tags for this Article

Informational Tags for this ArticleLocation Tags for this Article -

library_books 4 Reasons why there is very little warehouse space for lease or sale in East HoustonArticle Synopsis

Why is there little to no available manufacturing and/or storage warehousing available for purchase or lease near the Port of Houston? Strong local economy? Maybe. Top Port in the Nation in many stats? Partially. Booming energy sector? Possibly, but fading.

The real reason the industrial lease and sale market is so tight in East Houston near the port of Houston is due to an almost complete lack of development over the past 30 years in the Loop 610 East/Hwy 225/I-10 East/Port of Houston corridor out to Beltway 8. Yes there have been a few distribution projects which were developed on a speculative basis, however those have been full for some time. As for freestanding crane served warehouses from Loop 610 out to Beltway 8…there are less than 4-5 properties available on any given day. Is this a pure shortsightedness of developers? Probably somewhat. However, land is scarce and what is available is overpriced for industrial use. The Panama Canal will be opening soon and with an expected 20% increase in traffic in the short term, where will this business go? Probably to another port with adequate available storage and manufacturing warehousing.

Need Warehouse or Office space?

Centermark Commercial Real Estate specializes in Industrial and Office in the Greater Houston area. CCRE is the exclusive affiliate broker for WarehouseFinder.NET in Houston, TX.

Informational Tags for this ArticleLocation Tags for this Article -

library_books Houston area Industrial real estate - 2013 year end summaryArticle Synopsis

Warehouse brokerage in Houston, Texas…wow, what a year. 2013 may end up being a record year for many Houston commercial brokers, given the tremendous influx of businesses relocating and/or expanding into the area. However, the high demand results in “slim pickings” for business owners looking to acquire a warehouse for lease or sale. With an approximate vacancy rate of around 4.9% in 2013, the industrial real estate sector has little inventory for potential owners and lessees.

Moving into 2014, warehouse lease and purchase prospects will see continued rental and sales price increases on available warehouse space and premium rates and prices for the record number of freestanding warehouses under construction and proposed for the new year. The new construction is also driving up land prices and reducing availability of land parcels which lend themselves to industrial development.

As an Industrial real estate broker with 22 years in the Houston area, I am blessed to be doing business in Houston and really appreciate both the rewards and the challenges this market brings.

Eric Hughes - Industrial Real Estate Broker

Need Warehouse of Office Space?

Centermark Commercial Real Estate specializes in Industrial and Office in the Greater Houston area. CCRE is the exclusive affiliate broker for WarehouseFinder.NET in Houston, TX.

Informational Tags for this ArticleLocation Tags for this Article -

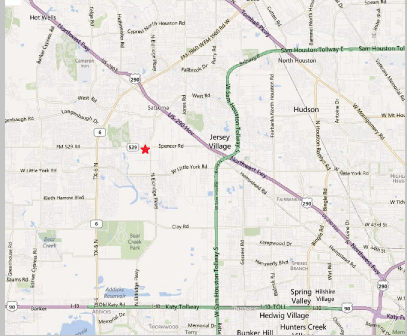

library_books Property Pick of the Week - 13601 FM 529, Bldg G - Office Warehouse for LeaseArticle Synopsis

Great warehouse for lease in Northwest Houston, outside the city limits. Tilt-wall warehouse with several vacancies:

- 3,240 SF

- 10,000 SF

- 9,000 SF with side fenced yard

All spaces have grade level loading, 17’ clear and heavy 480v 3 phase power available. Rates from $.38 PSF/month gross.

Need Warehouse or Office space?

Centermark Commercial Real Estate specializes in Industrial and Office in the Greater Houston area. CCRE is the exclusive affiliate broker for WarehouseFinder.NET in Houston, TX.

Informational Tags for this ArticleLocation Tags for this Article -

library_books 3PL Houston - Warehouse for lease - Short term floor space rentals - Alpha Hot Shot, IncArticle Synopsis

Looking for short term warehouse storage in Houston and don’t want to staff a warehouse and commit to a long term lease?

Informational Tags for this ArticleLocation Tags for this Article -

library_books What does it cost to build out commercial office space?Call Kenny Roch at KMR Construction and findArticle Synopsis

As a seasoned commercial real estate broker and developer at Centermark Commercial Real Estate, I have handled 100’s of commercial lease and sale transactions and then been involved in the buildout processes. Assuming all the sanitary sewer, water and electrical connections are reasonably located, plain office buildout runs about $38 to $45 PSF. This is turn-key with standard private offices, RACO doors (9’) and 28 oz. carpet. Medical finish with smaller rooms and multiple sinks runs about $65 PSF on the low end depending on finishes in the lobby/receptions areas (not including medical equipment). These estimates include full HVAC and minimum millwork in the break areas and restrooms. These estimates of cost PSF are more accurate on spaces over 3,000 SF. Smaller spaces tend to be higher PSF as you have a smaller SF by which to divide the cost of the restrooms, electrical, etc. If you need office space built out in a new building, are adding space to existing offices, or just want to upgrade your commercial property, contact our preferred contractor in Houston and does great work:

Call Kenny for a bid on your office build-out!

Kenny RochKMR Construction LLC

- Tell Kenny that you found him on Warehousefinder.net and he will move you to the front of the list! 🙂

Need Warehouse or Office space?Centermark Commercial Real Estate specializes in Industrial and Office in the Greater Houston area. CCRE is the exclusive affiliate broker for WarehouseFinder.NET in Houston, TX.

Informational Tags for this ArticleLocation Tags for this Article -

library_books Heavy machinery, material and equipment storage services - HoustonArticle Synopsis

Many companies do not have the resources to man a warehouse for short or even long term to handle its excess machinery, material and/or equipment. There are companies who specialize in this service with heavy crane served warehouses and heavy capacity lifts. They will do daily storage or yearly terms.

If you need help with the storage of machinery, material and/or equipment, contact:

(tell JD you found him on Warehouse Finder for special pricing!)

J.D. SilverMEI - Rigging & Crating3004 Aldine Bender RoadHouston, TX 77032Phone: 281-442-0544, FAX: 281-442-0547, Cell: 713-471-2803Need Warehouse or Office space?Centermark Commercial Real Estate specializes in Industrial and Office in the Greater Houston area. CCRE is the exclusive affiliate broker for WarehouseFinder.NET in Houston, TX.

Informational Tags for this ArticleLocation Tags for this Article -

library_books Crane served warehouse for Lease or Sale - New Listing! - 5520 Armour, Houston, TXArticle Synopsis

Centermark Commercial Real Estate has just listed warehouse for Lease or Sale at 5520 Armour Dr, in Houston, Texas located very near the Port of Houston. This crane served industrial property consists of approximately 71,337 SF of office warehouse on 2.65 acres of land. The warehouse has multiple dock high doors and drive thru grade level access with 16’ to 22’ clear. The warehouse has two (5) ton overhead cranes and 7,000 SF of a/c tech and/or office area.

Centermark Commercial Real Estate specializes in Industrial and Office in the Greater Houston area. CCRE is the exclusive affiliate broker for WarehouseFinder.NET in Houston, TX.

Informational Tags for this ArticleLocation Tags for this Article -

library_books How to Lease or Rent a Small WarehouseArticle Synopsis

When I need to lease a small warehouse, how do I this search? Who will help me, and what resources might I need or want to take advantage of…Informational Tags for this ArticleLocation Tags for this Article

When I need to lease a small warehouse, how do I this search? Who will help me, and what resources might I need or want to take advantage of…Informational Tags for this ArticleLocation Tags for this Article -

library_books Houston Commercial Real Estate's Rising Property Taxes: Is Harris County Appraisal District PuttingArticle Synopsis

The overall tone in the Houston commercial real estate market is an optimistic one. Experts are speculating a continued turn-around for this year and beyond. One would assume this is good news for Houstonians - not necessarily. It seems property owners are not the only ones paying attention to real estates “sunny forecast.”

In a preemptive attempt to balance the market values with the appropriate taxes, the Appraisal Districts have begun to increase commercial real estate property taxes. According to Harris County Chief Appraiser, Jim Robinson, “the values of commercial and industrial real properties and apartment properties are all beginning to show strong signs of economic recovery. These three categories of property are expected to increase between 6-11%.”

Out of 600 commercial real estate properties included in a recent study, it was found there are significant appraisal value increase, across the board:

- Retail - The average increase was 18.4%, with the highest increases in A&B-class properties. The largest increase found was as much as 84% year-over-year

- Multifamily - Average increase - 17.8%. The hardest hit were the B & C-class properties, with as much as a 129% and 184% value increases over last year

- Office - office properties are experiencing increases of 23.5% on average, with highest value increases occurring in B-class properties and some reaching as much 85% and 98.9% higher than the 2011 tax value

In every realm, decision making without a thorough understanding of all factors is never a good thing. Unfortunately for Houston property owners, that seems to be precisely what the Harris County Appraisal District is doing.

So what can you do? Fight your taxes! A professional tax consultant can help you help the Appraisal District to see that through their efforts to “balance” the market, they are actually tipping the tax scale.

Informational Tags for this ArticleLocation Tags for this Article -

library_books ATCO Business Park - New Construction - Office/Warehouses13701 FM 529 - For Sale or LeaseArticle Synopsis

Freestanding Flex-Service Office/Warehouse Buildings - 6,000 SF to 12,000 SF Shell Complete

Call for Reduced Pricing Information

Centermark Commercial Real Estate has been retained to market the newly developed ATCO Business Park in Northwest Houston. We have two buildings shell complete, 6,000 SF and 12,000 SF.

The project will ultimately consist of fifteen (15) freestanding buildings for sale or lease in Northwest Houston. While geared towards light industrial and service uses, the buildings can accommodate 100% office finishes as well.

ATCO Business Park has been designed to offer a more contemporary feel and look to its product. These are not ordinary metal buildings. The developer’s goal was to provide attractive structures without compromising function. Each office/warehouse provides dedicated storage yard area, ample area for dock wells and 480 volt, 3 phase electrical service. These clear span buildings are fully insulated. Crane capable warehouses will also be offered over 10,000 SF.

ATCO Business Park has been designed to offer a more contemporary feel and look to its product. These are not ordinary metal buildings. The developer’s goal was to provide attractive structures without compromising function. Each office/warehouse provides dedicated storage yard area, ample area for dock wells and 480 volt, 3 phase electrical service. These clear span buildings are fully insulated. Crane capable warehouses will also be offered over 10,000 SF.Located in Northwest Houston on FM 529 and outside the city limits, this industrial park is in the high demand NW quadrant. Because we are outside the city, the tax rates are low at $2.34 per $100 of value. ATCO BP is a great compliment to the nearby Northwoods Industrial Park which caters to larger crane served tenants. Quality freestanding buildings for sale or lease under 20,000 SF are rare in Houston and ATCO BP is eager to meet the demand.

Looking for Warehouse, Office or other space in Houston or elsewhere? Needing to renew your lease?

Contact the WarehouseFinder.NET Broker Affiliate Network below.

Centermark Commercial Real Estate specializes in Industrial and Office in the Greater Houston area. CCRE is the exclusive affiliate broker for WarehouseFinder.NET in Houston, TX.

Informational Tags for this ArticleLocation Tags for this Article -

library_books Commercial Warehouse for Lease - Property CategoriesArticle Synopsis

“Commercial warehouse” as a label is broadly used to describe a number of types of commercial space typically offered for lease or rent. For purposes of this article, we will use Five (5) main categories.

General Office/Warehouse

Typically grade level, this type of building is suited to businesses that provide a product and need to receive materials/items and ship out materials/items which may be at grade level or at dock high. The dock-high loading requirement with smaller freestanding buildings is usually facilitated thru use of in ground dock truck wells where the truck backs down a ramp to adjust for the height of the shipping container.

Bulk Distribution

Used for the distribution of palletized products in large volume, these buildings have true 4’ dock high loading with multiple doors, high clear height and fire protection systems.

Heavy Manufacturing

With grade level overhead doors and ample outside storage yard, these buildings often have large overhead cranes, heavy power and high clear heights.

Flex office/warehouse (aka Service Center Space)

Heavy office ratio and air-conditioned and heated areas used for tech or assembly are common with Flex space. High parking ratios and generally higher end business park settings are also popular with this type.

Truck Terminal w/Cross Dock

Used to transfer goods quickly from container to container, these buildings are usually very shallow and long to allow for a very high number of offloading spaces and overhead doors. Additionally, an abundance of trailer storage area and staging yard is normally required.

These are some of the main categories of buildings in Commercial Warehouses which are found for Lease.

For a more recent article with an updated list, go here.

For help finding a qualified industrial broker in your area and the perfect warehouse for your business call WarehouseFinder.net at 800.814.4214

Informational Tags for this ArticleLocation Tags for this Article -

library_books Free Rent! Warehouse for Lease! Really? - Let Me Explain...Article Synopsis

“So we need to lease a warehouse - how much free rent can you get us?” That is a common question I get from my clients. It generally does not matter if they are local or global, $100k/year or $100mm/year, everyone wants to feel they got the upper-hand or a good “deal.” But what does “free rent” really mean?

Free rent is, in most circumstances, a period of time where the tenant pays no rent or partial rent during the lease. This period is usually front loaded on the lease term. This is a great marketing ploy for landlords and is generally a win for the tenant too. It is pushed as a savings in rent to offset move-in and set-up costs incurred by the tenant. Free rent is also called “Rental Abatement” - which is, as a description, generally more palatable to Landlords. Owners hate to give away money. At the end of the day, owners want to lease their properties up and if they can lease it now, give a few months of free rent and eliminate the risk of additional months of vacancy, then it ends up being a wash for the owner.

Let me explain the tricks around Free Rent. Typically, free rent is never free. Rental abatement is recouped later in the lease. While time value of money may be gained, the Landlord will generally pad his proposal to account for any opportunity costs. As an example, if you as the tenant want to rent 10,000 SF for 60 months and the Landlord gives you 3 months free rent, he will typically add the months to the term of the lease - so 63 months. Now the Landlord will want rental increases in later years and will start those “bumps” in month 13 of the lease. Now the added three months will be at the highest rate in the term, thereby increasing the average rate over the lease.Free rent up front is a plus for the tenant, provided the tenant does not have to pay more in rate over the term in order to get the free rent.

Looking for Warehouse, Office or other space in Houston or elsewhere? Needing to renew your lease?

Contact the WarehouseFinder.NET Broker Affiliate Network below.

Centermark Commercial Real Estate specializes in Industrial and Office in the Greater Houston area. CCRE is the exclusive affiliate broker for WarehouseFinder.NET in Houston, TX.

Informational Tags for this ArticleLocation Tags for this Article -

library_books How to Use a Grade Level Facility for Dock-High LoadingArticle Synopsis

This article attempts to answer the question “Can I achieve dock-high loading/unloading using a grade-level building?” The fundamental problem addressed by warehouse loading areas - or docks in this article - is how facility team members get materials from the shipping surface of trucks, trains, etc., onto the facility floor for further handling…Informational Tags for this ArticleLocation Tags for this Article

This article attempts to answer the question “Can I achieve dock-high loading/unloading using a grade-level building?” The fundamental problem addressed by warehouse loading areas - or docks in this article - is how facility team members get materials from the shipping surface of trucks, trains, etc., onto the facility floor for further handling…Informational Tags for this ArticleLocation Tags for this Article

Need More Details?

Want more information about something on this page? Need industrial, office or warehouse space? Use our Free Property Search form to provide your information to let our Broker Affiliate Network know about your needs including help assessing an existing lease. You may also call us at (800) 814 - 4214 to begin the discussion.

Please contact us at our Info Email address or use our Contact Us form if you have questions or concerns.

As Seen On